ADA Price Prediction: Will Cardano Reach $1 in 2025?

#ADA

- ADA trading 20% above 20-day MA shows strong bullish momentum

- MACD convergence suggests weakening bearish pressure

- Positive news flow and institutional interest support upward trajectory

ADA Price Prediction

ADA Technical Analysis: Bullish Signals Emerge

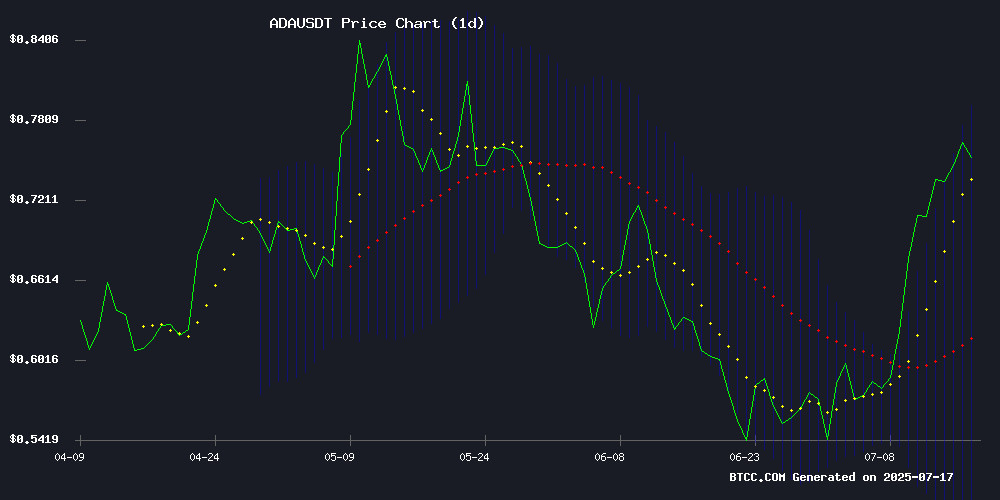

According to BTCC financial analyst Robert, ADA is currently trading at $0.7728, significantly above its 20-day moving average of $0.6408. The MACD histogram shows decreasing bearish momentum (-0.033488), while the price sits comfortably between the Bollinger Band middle ($0.6408) and upper ($0.7961) bands. This technical setup suggests potential for continued upward movement.

Market Sentiment Turns Bullish for ADA

BTCC's Robert notes the recent 23% ADA price surge aligns with growing institutional interest and technical breakout signals. News headlines highlight increasing trader accumulation and volatility, with Unilabs Finance gaining traction on the Cardano network. These developments create positive momentum that could support further price appreciation.

Factors Influencing ADA's Price

Cardano (ADA) Price Surges 23% on Institutional Interest and Technical Breakout

Cardano's ADA token has emerged as a standout performer this week, rallying 23.3% to $0.77 and claiming the position of second-best performer among top 10 cryptocurrencies. The surge follows a decisive breakout from a multi-month descending channel, confirmed by above-average trading volumes—a hallmark of genuine institutional accumulation rather than speculative froth.

Technical indicators now flash bullish across all timeframes. ADA has not only crossed its 200-day exponential moving average but also formed a golden cross pattern, historically a reliable precursor to extended uptrends. Analysts identify near-term targets at $0.87, with a longer-term trajectory toward $1.40 should momentum sustain.

Fundamentals align with the technical narrative. New ecosystem integrations with XRP and institutional-grade infrastructure upgrades via Apex Fusion suggest growing enterprise adoption. Market participants increasingly view Cardano as a blockchain maturing beyond development phase into real-world utility.

Unilabs Finance Gains Traction as Cardano Shows Volatility

Unilabs Finance, a nascent asset management platform, has surged past $5.2 million in presale funding following its live wallet reveal. Market analysts are flagging it as a potential standout investment amid turbulent conditions in the crypto sector.

Cardano's ADA token, meanwhile, has defied expectations with a 28% weekly rally, breaching a persistent descending channel pattern. The move to $0.77 resistance comes as Bitcoin's upward momentum spills over into altcoins—though experts caution the breakout remains fragile.

Cardano (ADA) Nears Critical Breakout as Traders Accumulate Ahead of Potential Rally

Cardano's ADA is testing a decisive resistance level at $0.78 amid rising trading volume and bullish technical formations. The cryptocurrency has broken free from a multi-month descending channel, with its current parabolic curve formation suggesting accelerating upward momentum.

Binance order books reveal growing long positions among institutional traders over the past 48 hours. The asset now approaches the neckline of a double bottom pattern at $0.80—a breakout could propel ADA toward the psychologically significant $1.00 threshold and beyond.

Market technicians highlight ADA's consolidation above the $0.63 Fibonacci support level, which previously served as resistance. The tightening price action beneath current resistance, coupled with increasing volume on upward moves, mirrors historical breakout precursors observed in other major altcoins.

Will ADA Price Hit $1?

Based on current technicals and market sentiment, ADA shows strong potential to test the $1 level. Key indicators to watch:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $0.7728 | Needs ~30% increase |

| 20-day MA | $0.6408 | Strong support |

| Bollinger Upper | $0.7961 | Next resistance |

| MACD | Converging | Bearish momentum fading |

Robert suggests that if institutional inflows continue and ADA breaks above $0.796, the $1 target becomes increasingly likely in the coming weeks.